Comparing costs at different colleges is often more complex than it needs to be, partly due to a lack of consistency from one college website to another. If you’re not careful, you run the risk of making decisions based on faulty information.

In this blog and in episode 16 of Tom Talks College, I’m going to break down costs for any college into three basic parts that are universal and can easily be compared. You’ll also learn a rule of thumb for typical costs at different types of colleges – including out-of-state and private – and you’ll learn how to use simplified numbers to make easy but more accurate comparisons between colleges.

This is the first in a series of three lessons on college + money. Next week you’ll learn about merit aid – the gift that keeps giving, and your teen’s most profitable part-time job – and the following week you’ll learn how to calculate your Expected Family Contribution, and how to use that EFC number to better estimate your costs at different colleges.

Know the 3 basic parts and be sure to “bundle” T & F

Too many times I’ve heard people compare one college’s tuition to another college’s Cost of Attendance, a comprehensive budget that includes much more than just tuition. That’s like comparing the principal you’ll pay on a new house to the PITI (principal interest taxes insurance) on another. It’s bad math and it prevents you from making wise decisions.

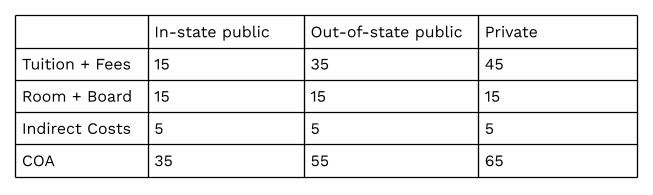

So the first step is to understand the three basic parts of the cost of college. Think about the three parts as learning (tuition & fees), living (room & board) and lattes (indirect costs – more on that later). Tuition and fees is where we’ll spend the most time – because that’s where you’ll spend the most money – and because it varies way more from college to college than the other two. And always look for the combination of the two, because some colleges post tuition and are less forthright about fees. (There’s a trend in higher education to shift more expenses to fees in an effort to keep tuition flat.)

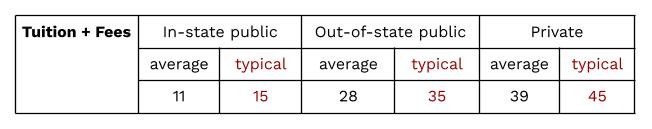

Let’s focus on tuition & fees and look at national averages for four-year colleges and universities for 2022-23. This data is from the College Board’s Trends in College Pricing report, and I’m rounding these off as a first step towards simplification.

- In-state public universities = $11,000

- Out-of-state public universities = $28,000

- Private colleges and universities = $39,000

The 15/35/45 rule

What’s more valuable than averages, however, are the numbers you’ll likely see in each of these categories for the schools that most interest you. Let’s call these typical costs, and here’s an example of why it will be more helpful to use a higher number than the averages.

The out-of-state public university average of $28,000 includes Colorado State-Pueblo, Colorado Mesa and Adams State, all fine schools and all located in the great state of Colorado. Their tuition and fees are included in the averages, and all fall well below $28,000, which is great. What’s no so great, however, is that if you don’t live in Colorado, you’re much more likely to be interested in CU-Boulder where the tuition & fees are $40,396 to $43,960 depending on your major, or Colorado State which is $32,734. So the typical cost we’re going to use for out-of-state public universities is based on “flagship” schools, i.e. the one or two biggest and most familiar names in each state.

The same is true for private colleges and universities. A quick analysis of six popular Midwestern private universities (St. Thomas, Marquette, Drake, Butler, Xavier and Creighton) reveals average tuition and fees of $47,860.

I’d rather overestimate costs of anything and be pleasantly surprised when something comes in lower, so here’s how we’ll adjust averages to more useful typical costs.

Notice that we’ve knocked off three zeros to arrive at the 15/35/45 rule.

Apples to apples

Let’s look back at CU-Boulder and CSU now that we have the 15/35/45 rule and see how each compares. Buffaloes in Boulder will pay 40 to 44, which is 5-9 above, and CSU Rams will pay 33, which is a modest but welcome 2 less. Obviously that’s just one data point and now we need to look at room & board, indirect costs, and financial aid to get a more complete picture. But do you see how knowing the 15/35/45 rule quickly puts everything into context?

We’ve only talked about tuition & fees because that’s the biggest chunk of the three basic parts, and it’s the most variable, but your student needs a place to sleep and eat, too. The national average for room and board is $13,000 and that’s what I’ve used as an easy number for several years, but I’m afraid it’s time to adjust that to $15,000. Room & board costs are rising more quickly than tuition & fees, and you’re less likely to spit out coffee if you plan for 15 and the real number comes in lower.

A quick word about lattes and indirect costs…

- Books & supplies = $1200

- Travel = $1200

- Miscellaneous = $2220

That’s $4600 total but colleges really vary on their estimates, plus something like travel could be widely different based on location. Use a simple 5 for typical costs.

To be honest, I don’t even pay attention to indirect costs. I only focus on the two parts that make up direct costs. Is that poor financial planning? No, because I’m pretty sure that what you spent on club volleyball, prom, and feeding a teen adds up to more than $5000 per year. So think of it as a wash.

Let’s pause for a second to remind ourselves that all of these numbers are subject to change based on financial aid, so we’ve only been looking at sticker prices up until this point. Next week I break down what merit aid is and why an understanding of it is critical to opening up options outside your state and beyond public universities. Merit scholarships open doors you didn’t know existed.

Now let’s put all three parts together to see typical Cost of Attendance figures for all three types.

If you’d like to hear a few more examples of how actual costs compare to typical costs, and how you can quickly go from not knowing the costs of a college to wrapping your head around it and being able to see if it’s a possible financial fit, listen to the second half of episode 16 of Tom Talks College. In addition to this college + money series, you’ll find practical guidance on everything from campus visits to finding the right college to standardized testing to suggested timelines for your student.

Having a conversation beyond the numbers

If you’re struggling with any part of this – or if you just want to talk to someone who thinks about this everyday – email me anytime or schedule a free consult and let’s talk not just about the numbers, but about your family and your students, and what you hope to achieve.

Recent Comments