Estimating College Costs with Net Price Calculators

This is part 3 of a 3-part series on College + Money, and you can learn more about this topic as well as parts 1 and 2 referenced below on the Tom Talks College podcast.

How much will we really pay?

In the first part of this series, “College Costs Simplified: The 15/35/45 Rule” (episode 16) highlighted the three basic parts of college costs and an easy to remember 15/35/45 rule to give you a ballpark of the most important part: tuition and fees. Part 2 “Merit Aid: Your Teen’s Best Part-Time Job” (episode 17) went beyond sticker price to find merit aid and show you that many colleges offer generous discounts for good grades and test scores. Net Price Calculators are one more tool to understand college costs in a more personalized way.

What is a Net Price Calculator (NPC)? Where do I find it?

Net Price Calculator = financial tool found on college websites that’s designed to provide an estimate of your costs using inputs such as EFC or income and assets, family size, number of children in college, and academic data like GPA and test scores

Many NPC’s ask for household income or allow you to plug in your Expected Family Contribution. Here’s a definition straight from Studentaid.gov.

Your Expected Family Contribution (EFC) is an index number used to determine your eligibility for federal student financial aid. This number results from the information you provide in your Free Application for Federal Student Aid (FAFSA®) form. Your EFC is calculated according to a formula established by law and considers your family’s taxed and untaxed income, assets, and benefits. Schools use the EFC to determine your federal aid eligibility and financial aid award. Your EFC is not the amount of money your family will have to pay for college, nor is it the amount of federal student aid you will receive. It is a number used by your school to calculate how much financial aid you are eligible to receive.

That last part is highlighted because some families assume that their EFC is what they’ll pay, but it’s not. It’s just one part of the financial aid process. If you’d like to calculate an estimate of your EFC, use the Federal Student Aid Estimator.

How do colleges use my EFC?

Here’s a very simplified version of the financial aid formula.

Cost of Attendance (COA) – EFC = need

Cost of Attendance is a sample budget for a first-time full-time student, and let’s use UW-Madison’s COA for in-state residents as a reference.

- Tuition and fees $11,216

- Room and board $13,500 (remember that these top two parts are “direct costs”)

- Miscellaneous $4200 (“indirect costs” such as books, travel, etc.)

- Total $28,916

So if you had an EFC of $28,916 or more, UW-Madison’s financial aid office would determine that your “need” was zero. They’re not saying you have all that in the bank or in a 529; they’re just telling you what your need is according to their formula.

If your EFC was $20,000, your need would be $8916, but that doesn’t mean you’d get an $8916 discount, scholarship or grant. You’d probably qualify for federal student loans and that would make up the bulk of your financial aid package.

This is where EFC can be misleading. It’s just one number that goes into the process, and colleges are under no legal obligation to “meet need”.

Now let’s turn our attention back to NPC’s and see some examples that range from very helpful to almost worthless.

We love you, Athens, but your NPC stinks

Colleges often use a third-party plugin for their NPC, which is why you’ll see so many that look similar. I chose the University of Georgia as an example because it’s a personal favorite even though they do not post a “merit matrix” and offer limited scholarships to out-of-state students. As soon as I saw the site, I knew the NPC would ask for very little and deliver even less. Take two minutes to work through the University of Georgia’s net price calculator, and you’ll notice they didn’t ask for any information that would lead to academic merit aid, and they asked for a range of household income instead of your EFC. This really didn’t help us get any closer to a personalized estimate other than “we probably won’t get much if anything” – and they’re using numbers from 2020-21 to boot! C’mon, Bulldogs. You can do better.

Ohio Wesleyan, you are my new best friend

After the frustration of Georgia’s NPC, I turned to one I remember as excellent: Ohio Wesleyan. After a few easy questions about my student, I entered a GPA and was immediately shown a potential merit scholarship of $28,000 per year. That’s a discount of 53%, and I’m now well below the 45 for private colleges and universities in the 15/35/45 rule.

After what I can only describe as a smiling page of their NPC that says, “Pretty cool, huh?” you’re invited to enter financial data to check for possible need-based aid.

Every NPC requires you to check a box agreeing that this is just an estimate, and even the best can never be more than an estimate – but can you see how valuable a quality NPC can be in your family’s search for accessible and affordable best-fit colleges?

MyinTuition is the (potential) game changer

It’s incredibly hard to talk about college costs, NPC’s, admissions data or almost anything college-related without veering into too many rabbit trails of exceptions and case-by-case situations. So I’ll just say a quick, “Hey, can I share one more thing before you go?” that will put smiles on some of your faces and cause others to throw up in their mouths.

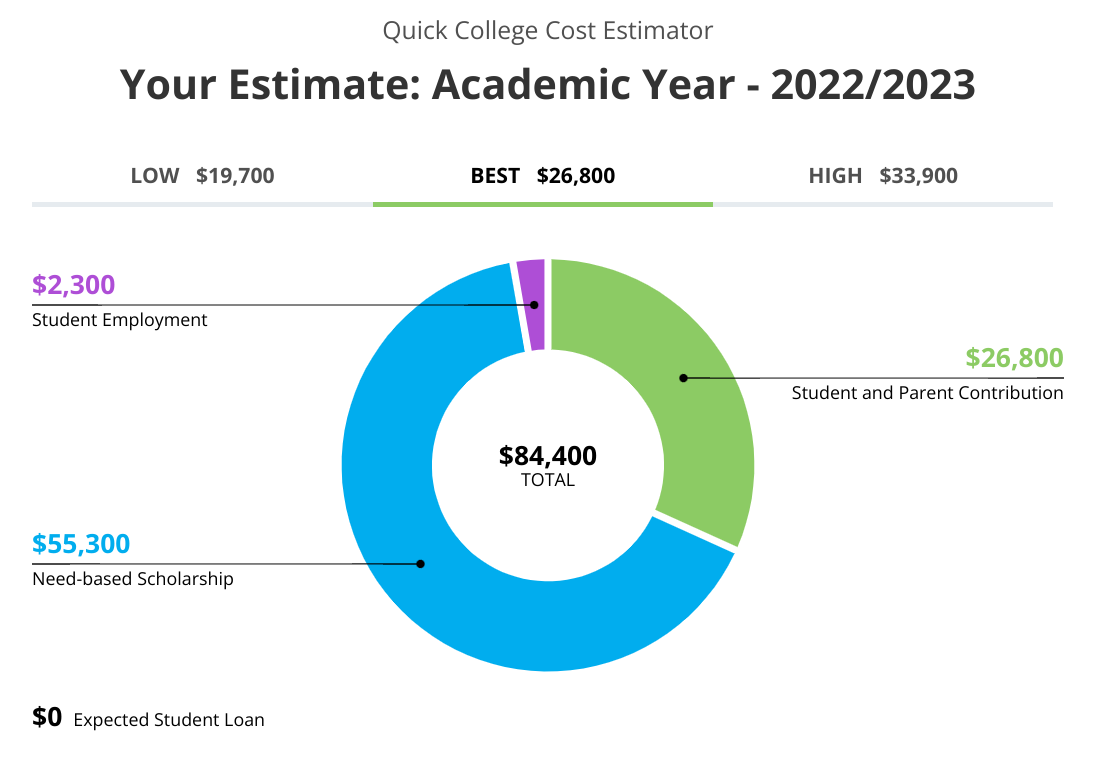

Roughly 75 of the most selective schools use an NPC called MyinTuition, sometimes in addition to a more standard version. One of the more popular “Ivy Plus” colleges is Vanderbilt, where the COA is just north of $84,000. Gulp. MyinTuition prides itself on ease-of-use and minimal questions, so let’s pretend we have one more boy in the house who is a junior and really loves him some Nashville. I’m plugging in our numbers now and will time myself and record my response as accurately as possible. (I’ve done this for others on the list but not the Commodores.)

It took just under two minutes, and I shook my head with a pleased “hmmm” when I saw these numbers.

The Kleese’s are kicking in $26,800, unnamed son #3 will work at the library or set up chemistry labs as his dear mother did to earn $2300 – and Vanderbilt picks up the tab for rest. MyinTuition always gives you a best estimate as well as a low and high, and when I click on those I just see our green part moving with the blue part adjusting as well.

This is great, right? Our EFC this year was around $40,000, so if you jump back to UW-Madison, we’re likely only qualifying for student loans but no scholarships or grants. And Vanderbilt is less than the $28,916 full price tag at Madison.

Now all we need is to adopt a super smart kid who can get into Vanderbilt, and then I’m the dad in the dad-polo enjoying an SEC game.

Your results may vary

Some of you are in different financial situations than we are, and I’ve sent MyinTuition out to enough parents and had enough “are you crazy?” responses to know that the green piece of their puzzle is sometimes overwhelming. But that’s still a good thing – because knowing or even expecting to pay whatever your costs may be is so much better than telling your student to “not worry about price and if you get it we’ll figure it out”. Will you? Should you even say that unless you have some basic information like this?

What now? Run some numbers!

Schedule one hour this weekend in a quiet room to calculate your EFC, and then use that number in NPC’s at colleges that interest you or your student. Seriously – one hour will teach you so much you didn’t know, and even if you don’t like what the NPC’s show you…at least you’ll know.

Call me at (608) 553-3445 and say, “Hey, I read the blog and listened to the podcast and did that one hour thing you suggested, and I just wanted to talk a little more about this.” I’d love to take that call and help you understand not just what I said and showed you, but listen to what you’re seeing and thinking, and then answer as many questions as I can on a phone call.

You can come in for a free consult with or without your student. And while we’re looking at all the options, you can also add a college expert to your team and invest an extra 1.3% of the four-year cost of your student’s college education in a proven process to make sure you’re writing the tuition checks to the right college.

Here’s how I got the 1.3% number, because it’s not percentage-based.

UW-Madison COA of $28,916 x four years = $115,664

Our standard college search package is $1500. $1500/$115,664 = .0129685987, or 1.3%

Up next

Here’s an email from a parent: “Excellent merit aid podcast…I think you should do a podcast directed to the students about how to not stress out about this entire process. Maybe one for type A moms.”

You got it.

Recent Comments